Welcome to this April newsletter from the Customer Union for Ethical Banking, the independent union for customers of The Co-operative Bank. This month, we review the Co-op Bank’s Sustainability Report in depth. Plus rumoured deals between investors on bank shares.

Save Our Bank view of the 2020 Sustainability Report

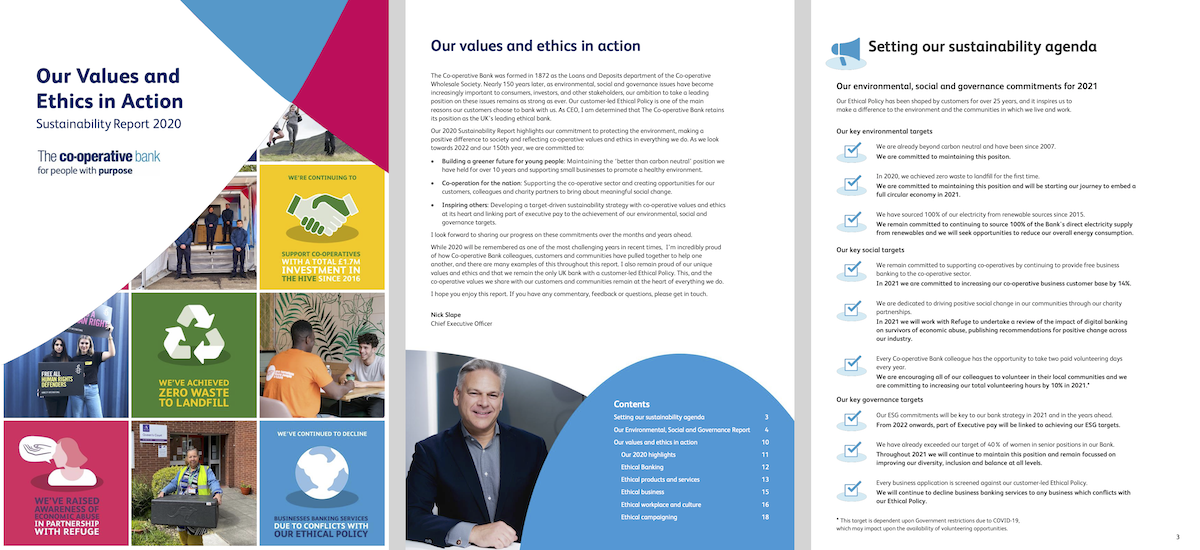

Just before we sent our last newsletter at the end of February, the bank released its 2020 Sustainability Report. This is the new name for its Values and Ethics report (or more accurately, a return to an old name). The report continues with a similar format to last year’s, although there are some notable improvements including key targets and checklists noting areas for improvement.

As a Customer Union dedicated to representing our members and ensuring the bank maintains its ethical commitments, each year we aim to review this report carefully and share our observations with you, as well as raising questions with the bank where necessary.

The following is a review of some notable aspects of this year’s report. We encourage you to take a look at the full report and let us know if you have further questions. Weighing in at just 21 pages, the same length as last year, it’s quite an accessible read.

Key sustainability targets for 2021

The report starts with a new and welcome development – a page of the bank’s “key targets” for the coming year. There are nine targets in total, split across the categories of “environmental, social and governance”, which each get three.

Several of these targets involve maintaining current good practice. These include sourcing 100% renewable electricity, maintaining at least 40% of women in management positions, and continuing ethical screening. In addition there are some eye-catching new targets. These include increasing the bank’s co-operative business customer base by 14%, making part of executive pay linked to achieving ESG (ethical and social goals) targets from 2022, and starting work on a circular economy approach to waste in 2021 - which we hope will reduce the 59% of the bank's waste sent to "energy recovery facilities", which typically involve incineration.

There are some omissions too – for example, the bank has told us it is planning a new Ethical Policy review in 2021, but this is not among the targets. We’d also like to see the bank be more ambitious in some of these areas: how about a target to ensure the bank is aligned with the Paris Agreement on climate change and to return to campaigning on this issue? However, we’re pleased to see the bank clearly flag its main sustainability ambitions up-front.

- Question for the bank: is there any reason the 2021 Ethical Policy review is not listed as a target or mentioned in the report?

Areas for improvement summarised in a checklist

This year’s report also includes an expanded section of data on the bank’s management of environmental, social and governance issues, alongside a “checklist” of metrics for each area. These metrics are mostly marked with a green tick – “We’re in a good position on this metric.”, although a few are marked as orange (“still have some work to do”) or with a red cross (“this is an area for development”).

Some of the areas the bank identified as needing improvement (i.e. marked orange or red) include:

- Greenhouse gas reporting: The bank notes it “does not currently report Scope 3 emissions” (i.e. those associated with its finance). See below for more on this.

- Environmental Management System: certification of this is noted as an area for development.

- Responsible marketing: The bank is “working towards development of a Responsible Marketing Policy and will take steps to publish this externally in 2021.”

- External standards: The bank has noted it is “not currently a signatory of the Global Compact, the Principles for Responsible Investment or the Equator Principles”, and marked this as an “area for development”. (We’re a bit surprised by this as we don’t see a pressing need for the bank to sign any of these standards - they are just not that relevant or helpful in the context of the bank’s business.)

It’s great to see reporting that doesn’t only highlight what the bank thinks it does well, but areas for improvement as well. Sustainability Reporting should be guided by this kind of “warts and all” approach.

Questions for the bank:

- Is the bank looking into signing the Global Compact, PRI and Equator Principles, and has it made an assessment of how relevant these are for the bank?

- The bank notes that “Environmental Management System Certification” is “an area for development” – can the bank comment further on its plans in this area?

Greenhouse gas emissions and paper use plummet in 2020

The Co-op Bank targeted a 10% decrease in its greenhouse gas emissions in 2020, but ended up seeing a 47% decrease, as the pandemic led to more working from home, less office use and less business travel. Emissions from employees working at home are not included. The bank’s new target is for a 27% reduction over 2021, using 2019 as a baseline – so it expects emissions to rise next year. Paper use fell even more massively, from over 20,000 reams to under 2,000.

The bank offsets its remaining emissions (which have been falling year on year), plus an additional 10% to address past impacts, leading to the bank’s claim of being “beyond carbon neutral”. However we should remember that the main impacts of a bank are those associated with its finance. The Co-op Bank’s so-called “financed emissions” are most likely much lower than most banks, even accounting for size, due to its long-standing stance of not financing the extraction and production of fossil fuels.

Time to measure and manage financed emissions

The Co-op’s stance of not financing fossil fuel extraction or production makes it a leader on climate change, at least among UK high street banks. However, as the rest of the sector gets moving on measuring and managing their financed emissions, the bank’s lack of progress on this is starting to threaten its leadership.

The Co-op identifies measurement of “scope 3 emissions”, which includes emissions from the companies it finances, as an area where it is “making progress …. but still [has] some work to do.” It notes that there is “work currently being undertaken within the financial services sector to establish a reporting framework for Scope 3 emissions” and says the bank will “look to implement this additional reporting once that framework is agreed.”

However, the reality is that there are already several such reporting frameworks that have been established and are being rolled out at other banks. For example, Barclays, Europe’s biggest and baddest financier of fossil fuels – has started measuring its scope 3 emissions for the energy and power sectors using its own methodology. Then there’s PACTA (“Paris Agreement Capital Transition Assessment”), a free, open-source toolkit launched in September 2020 which has been road-tested by at least 17 banks around the world. It’s not only big international banks that are in on the action either - one of the Co-op Bank’s main competitors in the ethical banking space, Triodos, has been measuring its financed emissions since 2018, according to its reporting. It uses the framework designed by the Partnership for Carbon Accounting Financials (PCAF), seen as a better solution for smaller and community-based banks.

The Co-op Bank has been a leader on climate change for years, but as more banks measure and reduce their financed emissions and aim for “net zero”, the Co-op needs to be more assertive on this front.

- Question for the bank: Which reporting framework for Scope 3 emissions is the bank referring to in its reporting? Has the bank considered and reached a view on existing emissions reporting frameworks?

Support for customers during the Coronavirus pandemic

The impacts of COVID are evident throughout the report, and not just in the bank’s drastically-reduced emissions and paper use. The bank is clearly and rightly proud of the work it has done through 2020 to support small business customers and charities. This includes allowing over 9,800 small businesses to access the government’s Bounce Back Loan Scheme and Coronavirus Business Interruption Loan Scheme – around 10% of its total small business customer base. It also includes payment holidays and other support and guidance for business customers and working with The Hive to provide free resources and guidance to co-operative businesses impacted by the pandemic (although this support was only accessed by 10 co-ops).

The value of this work is reinforced by quotes from the Chief Exec of homelessness charity Centrepoint, Seyi Obakin OBE, praising the way the bank “rose up wonderfully to offer tremendous support” to help young people through the crisis, and from Amnesty UK’s director, Kate Allen, describing how “the ongoing support of The Co-operative Bank has helped us to navigate a challenging 2020 … with their support we’ve been able to keep human rights on the agenda.”

- Questions for the bank: The report notes that the “Hive Assist Package, launched in response to the economic challenges, was accessed by 10 co-operative businesses”. Can the bank comment on why this wasn’t accessed by more co-ops?

21 businesses declined for ethical policy breaches

Both the number of businesses referred for ethical screening and the number declined for conflicts with the bank’s ethical policy were up significantly in 2020, with 438 businesses referred and 21 declined. This is up from 223 referrals and 4 declines in 2019. It’s the first year since 2013 that declines have been in the double-figures.

The businesses declined include a defence sector consultancy conflicting with the bank’s stance on oppressive regimes, a company involved in indiscriminate weapons, 16 businesses breaching the bank’s policy on oil and gas, and one organisation considered to be advocating incitement to hatred on the basis of religion. This goes to show the bank’s policy statements remain relevant, and that, perhaps surprisingly, some businesses involved in the most unethical and destructive activities continue to try to open accounts at the Co-op Bank!

No external audit yet, but it’s coming

As regular readers will know, the Co-op Bank has made a commitment to the Customer Union to bring back external assurance of its sustainability reporting. The bank has told us that this year’s report will be externally audited, and the report itself conforms this, stating “this report will be externally audited following publication.” We look forward the bank returning to external auditing of its ethical reporting before publication in future years.

Investors on manoeuvres

Sky News often seems to pick up on stories about the Co-op Bank that other media outlets have missed. Some of these lead nowhere, others turn out to be important.

This time Sky is reporting that two investment funds, Bain Capital and FC Flowers, are trying to buy the 10% of the bank owned by hedge fund BlueMountain Capital. Bain Capital is the very same that led on the demutualistion of LV=that we reported in our last newsletter.

We're not sure what this means for the future of the bank. But it does seem to be an indicator that the bank is being seen as a more interesting investment now that it is predicting a return to profitability soon.

Too long? Or Just right?

We know this month's newsletter was longer than usual - congratulations on reaching the end of it! We wanted to send you our review of the bank's Sustainability Report in full. If you have time, please click on the button below to let us know if you're happy to receive a longer newsletter once in a while (for example when we review the bank's annual reporting) or whether you prefer us to keep it shorter.

With thanks and best wishes,

The Save Our Bank team

Have you joined the Customer Union yet? It costs £12 a year to be a member of the first ever customer union co-operative, and help us ensure the Co-op Bank sticks to its principles. It only takes a few moments to sign up here.

info@saveourbank.coop

info@saveourbank.coop @SaveOurBank

@SaveOurBank @saveourbank

@saveourbank